Indian Financial System

Financial System refers to the financial needs of different sectors of the economy and the ways and means to meet such needs efficiently and economically. Funds are required for meeting various monetary needs.

The financial needs are met from different sources and agencies.

Indian financial system are given in the diagram below. ↓

Image credits © Manoj Patil.

The formal financial system consists of four components: ↓

- Financial institutions,

- Financial markets,

- Financial instruments and

- Financial services.

The financial system acts as a connecting link between savers of money and users of money and thereby promotes faster economic and industrial growth.

Thus financial system may be defined as “a set of markets and institutions to facilitate the exchange of assets and risks.”

Efficient functioning of the financial system enables proper flow of funds from investors to productive activities which in turn facilitates investment.

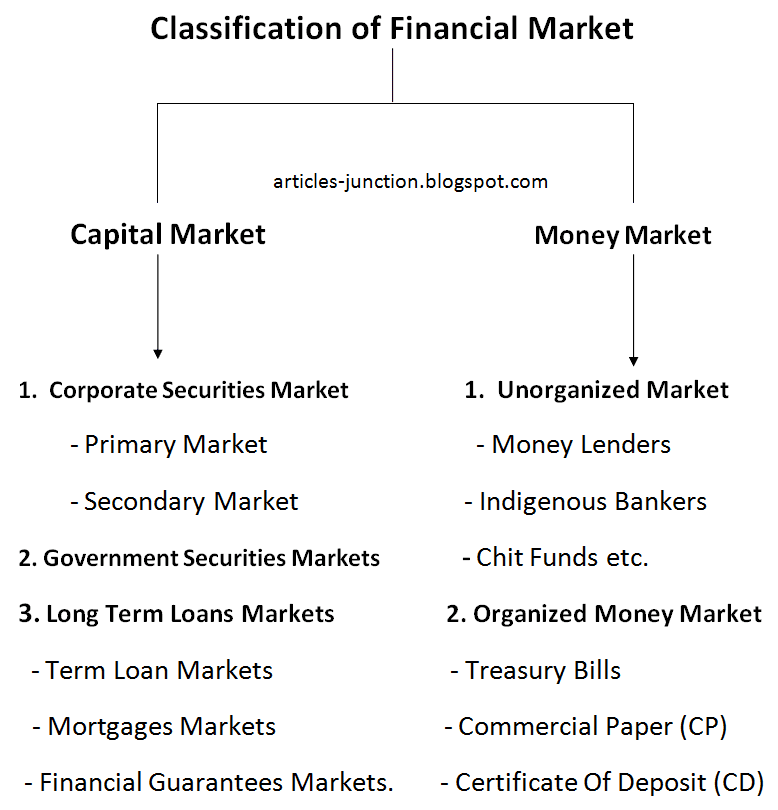

Classification of Financial Market in India

Type of financial market are given in the diagram below. ↓

Image credits © Manoj Patil.

The financial markets are classified into two groups: ↓

Capital Market

1. Corprate Market

- Primary Market

- Secondary Market

2. Government Securities Markets

3. Long Term Loans Markets

- Term Loan Markets

- Mortgages Markets

- Financial Guarantees Markets

Money Market

1. Unorganized Market

- Money Lenders

- Indigenous Bankers

- Chit Funds

2. Organized Money Market

- Treasury Bills

- Commercial Paper (CP)

- Certificate Of Deposit (CD) etc

- Call Money Market

- Commercial Bill Market

Capital Market

A capital market is an organized market. It provides long term finance for business. According to Shri, K.S. “Capital Market refers to the facilities and institutional arrangements for borrowing and lending long-term funds.”

Capital Market is divided into three groups: ↓

1. Industrial / Corporate Securities Market

It is a market for industrial securities. Corporate securities are equity and preference shares, debentures and bonds of companies. Industrial security's market is very Sensitive and Active Financial Market.

It can be divided into two groups: Primary and Secondary Market ↓

- Primary Market: It is a market for new issue of securities, which are issued to the public for first time. It is also called as New Issue Market.

- Secondary Market: In the secondary market, there is a sale of secondary securities. It is also called as Stock Market. It facilitates buying and selling of securities.

2. Government Securities Market

In this market, government securities are bought and sold. It is also called as Gilt-Edged Securities Market. The securities are issued in the form of bonds and credit notes. The buyers of such securities are Banks, Insurance Companies, Provident funds, RBI and Individuals. These securities may be of short-term or long term.

3. Long-Term Loans Market

Banks and Financial institutions provide long-term loans to firms, for modernization, expansion and diversification of business.

Long-Term Loan Market can be divided into: ↓

- Term Loans Market: Banks and Financial Institutions provide term loans to companies for a period of one year. The financial institutions help in recognizing investment opportunities to motivate emerging businessmen. They also give encouragement to modernization.

- Mortgages Market: It provides loans against securities of immovable assets like land and buildings.

- Financial Guarantees Market: Financial Institutions (FIS) and banks provide financial guarantees on behalf of their clients to third parties.

Money Market

Money Market is the market for short term funds i.e. for a period up to one year.

The money market is divided into two: Unorganized and Organized Money Market. ↓

1. Unorganized Market

Unorganized market consists of: Money lenders, Indigenous Bankers, Chit Funds, etc. ↓

- Money Lenders: Money Lenders lend money to individuals at a high rate of interest.

- Indigenous Bankers: They operate like money lenders. They also accept deposits from public.

- Chit Funds: These collect funds from members and provide loans to members and others.

2. Organized Money Market

Organized Markets work as per the rules and regulations of the RBI. RBI keeps a strict control over the Organized Financial Market in India.

Organized Market consists of: Treasury Bills, Commercial Paper (CP), Certificate Of Deposit(CD), Call Money Market, Commercial Bill Market. ↓

- Treasury Bills: To raise short term funds treasury bills are issued by Government. It is purchased by Commercial Banks. At present, Government issues 91 days and 364 days treasury bills.

- Commercial Paper (CP): Commercial paper is issued by companies who are listed on Stock Exchange. CP is issued at discount and repaid at face value. The maturity period ranges from 7 days to one year. CP's are issued in multiple of 5 lakh. The company issuing CP must have tangible net worth of at least 4 crore.

- Certificate Of Deposit (CD): CD's are used by Commercial Banks and Financial Institutions to raise finance from the market. The maturity period for CD's is between 7 days to 1 year. CD's is issued at a discount and repaid at face value. CD's is issued for a minimum of 25 lakhs.

- Call Money Market: A loan which is taken or given for a very short period, that is for one day is called Call Money Market. It involves lending and borrowing of money on a daily basis. No security is required for these very short-term loans.

- Commercial Bill Market (CBM): This market deals with Bills of exchange. The drawer of the bill can get the bills discounted with Commercial Banks. The Commercial Banks can get the bills rediscounted with Financial Institutions.

nicely laid article

ReplyDeleteUseful for rrb preparation.

ReplyDeleteThanks..helped alot..

ReplyDeleteThank you so much for making things easy to understand

ReplyDeleteIts really informative

ReplyDeleteinformation is not complete in its own there are lot more things that you can add to it. anyway it is helpful.

ReplyDeletethanks

It helps to me alot,..

ReplyDeletevery use full

ReplyDeleteIt was helpful thanks

ReplyDeleteIt’s very helpful and it’s properly explained

ReplyDeleteNot bad...😒

ReplyDelete